Buying a Property in Virginia water and Upper Longcross

Virginian water takes great pride in the great attractiveness of its nature. If you are a person who loves the peaceful town life and has just made an interest in buying a Virginia water home , you are lucky – you will find a lot of royal parks, golf clubs , streams and lakes , upon that you might find some wonderful waterfront homes in the town .

Virginian water takes great pride in the great attractiveness of its nature. If you are a person who loves the peaceful town life and has just made an interest in buying a Virginia water home , you are lucky – you will find a lot of royal parks, golf clubs , streams and lakes , upon that you might find some wonderful waterfront homes in the town .

Real Estates agents specialize in Surrey property. They have an in-depth knowledge of the houses for sale in Virginia water and Upper Longcross and would be ready to help you in discussing your home-owning ideas and choosing the best property for you to evaluate and explore at your free time.

Whether you have a particular home in mind, or you are trying to explore and seeing various property for sale in Virginia water, or are just starting to invest a property in Upper Longcross, they will be willing to discuss with you, answer any relevant questions you might have, and help you in any respect they can.

Virginia water offers significantly natural beauty in the town. Whether you dream of a single family home, a luxury estate in the town, or a multimillion mansion is one of the questions you need to ask. Your questions will be answered, it helps make your search much narrowed.

When considering houses for sale in Upper Longcross and Virginia water there are many aspects to consider, and the agent is dedicated to helping you find your dream home. This real estate agent is dedicated to both the sale and purchase of: estates, luxury homes, mansions, villas, and farms. The realtors are really experienced and up-to-date on the houses for sale in Surrey.

There are some other aspects to consider when finding houses for sale in Upper Longcross and Virginia water such as: style, size, and acreage, year built, when looking for a property and some could be more flexible than others, and this is something that you must consult with an agent, especially When you are ready to start your finding of property for sale in Surrey, or need an agent to help you more.

Also, it’s not difficult to notice why so many people choose to retire in Virginia water and Upper Longcross . With a peaceful living space, a lot of social communities in public areas and peacefulness, these places are incredibly a hit among the elders looking to best property for retire.

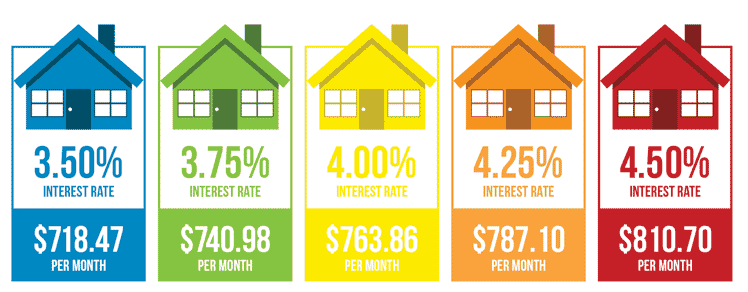

The company you get your mortgage from is a huge factor in the rates you get and ensuring that you’ll get the best deal overall. It’s important that you remember to shop around and get information from several different Florida mortgage lenders each have different terms and conditions with regards to residential mortgage rates and you need to make sure you know what you are signing up for; credit unions and commercial banks, for example, will set up different guidelines and criteria for getting cheap mortgage rates. On top of that, the rates themselves will vary.

The company you get your mortgage from is a huge factor in the rates you get and ensuring that you’ll get the best deal overall. It’s important that you remember to shop around and get information from several different Florida mortgage lenders each have different terms and conditions with regards to residential mortgage rates and you need to make sure you know what you are signing up for; credit unions and commercial banks, for example, will set up different guidelines and criteria for getting cheap mortgage rates. On top of that, the rates themselves will vary. North Carolina is a state situated in the southeastern US. The state comes with various improvements, from sea level along the shoreline to over 6000 feet in the mountain range, and therefore has the most varying climate. It also has an effect on the North Carolina real estate condition. Those who desire the warm subtropical climate find residential properties in the vicinity of the coast. Those who want a peace and quiet environment, far away from the busyness of metropolises, find a home in the mountains. Generally, the multiple climates do for a major boost for North Carolina real estate property.

North Carolina is a state situated in the southeastern US. The state comes with various improvements, from sea level along the shoreline to over 6000 feet in the mountain range, and therefore has the most varying climate. It also has an effect on the North Carolina real estate condition. Those who desire the warm subtropical climate find residential properties in the vicinity of the coast. Those who want a peace and quiet environment, far away from the busyness of metropolises, find a home in the mountains. Generally, the multiple climates do for a major boost for North Carolina real estate property. Construction cost has become the trickiest issues you have to get through when having some construction projects with any contractor. The point is, you might want the finest quality without really going over your budget for that specific construction project.

Construction cost has become the trickiest issues you have to get through when having some construction projects with any contractor. The point is, you might want the finest quality without really going over your budget for that specific construction project. An attorney can help you create a construction contract that give protection to your construction projects and gives your client a secure feeling. A specialized construction attorney will often provide help to draft a contract that will tailor to match your construction project

An attorney can help you create a construction contract that give protection to your construction projects and gives your client a secure feeling. A specialized construction attorney will often provide help to draft a contract that will tailor to match your construction project